The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. Second, we also include links to advertisers’ offers in some of our articles these “affiliate links” may generate income for our site when you click on them. This site does not include all companies or products available within the market.

The compensation we receive for those placements affects how and where advertisers’ offers appear on the site. First, we provide paid placements to advertisers to present their offers. This compensation comes from two main sources.

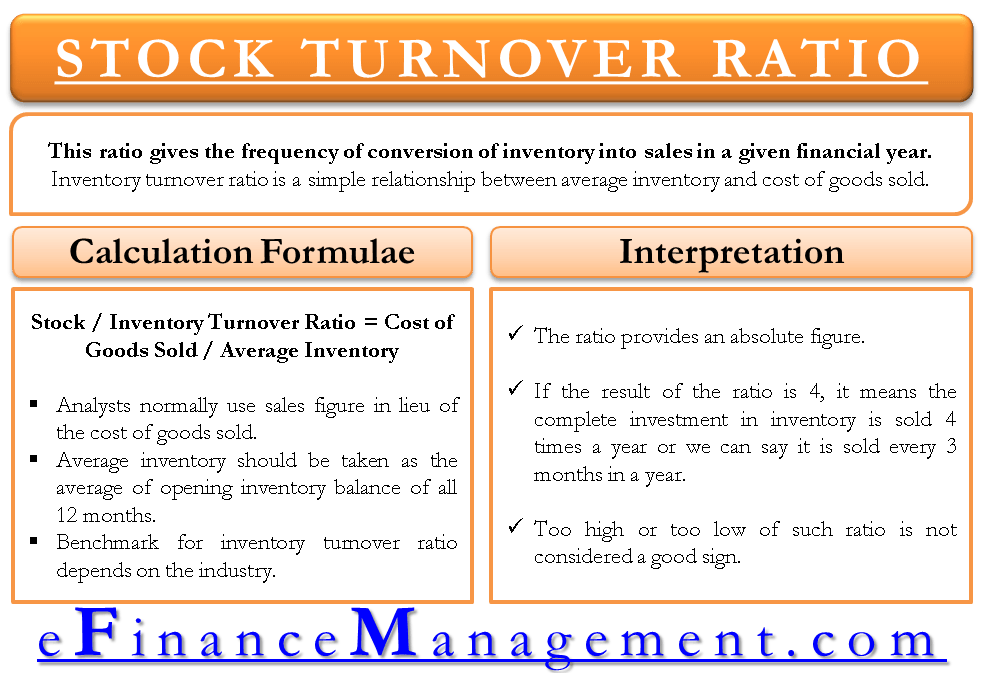

#ACCOUNTING INVENTORY TURNOVER RATIO FOR FREE#

To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The Forbes Advisor editorial team is independent and objective. As you can see, this company has been holding on to its inventory for quite a long time compared to the other examples. Looking at the third example above, we’ll calculate the inventory rate based on 365 days. It would take approximately 11 days to replenish inventory in this example. Using the clothing store example with an inventory turnover ratio of eight, we’ll calculate the replenishment time frame based on one-quarter’s worth of inventory (90 days). If the period in question is one year, or 365 days, then it would take approximately seven days to replenish inventory on average. Take the automotive parts store with an inventory turnover rate of 50. Inventory Turnover Rate = Days in Period / (COGS / Average Inventory) Example 1 This calculation tells you how many days it takes to sell the inventory on hand. The inventory turnover rate takes the inventory turnover ratio and divides that number into the number of days in the period. In this case, a low turnover ratio could indicate poor inventory management. Having a low inventory turnover may be caused by over-purchasing inventory that doesn’t sell as fast as other types of products. If your COGS is $200,000 and your average inventory is $50,000, your turnover ratio would be four ($200,000 / $50,000 = 4). Perhaps you have a company with a low inventory turnover, which means you don’t replenish inventory very often. This means the store is changing the inventory eight times in the given time period. This yields an inventory turnover ratio of eight ($160,000 / $20,000 = 8). Assume the retailer has $160,000 in COGS with $20,000 in average inventory. Example 2Ī clothing retailer generally has a lower turnover ratio. This is an industry where high turnover ratios are common. That means that the automotive parts store is going through inventory 50 times in the defined period of time. Inventory Turnover Ratio = COGS / Average Inventory Value Example 1Īn automotive parts store has a COGS of $500,000 with an average inventory of $10,000. The information for this equation is available on the income statement (COGS) and the balance sheet (average inventory). This equation will tell you how many times the inventory was turned over in the time period. Inventory turnover is calculated by dividing the cost of goods sold (COGS) by the average value of the inventory.

0 kommentar(er)

0 kommentar(er)